south dakota used vehicle sales tax rate

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. In addition for a car purchased in South Dakota there are other applicable.

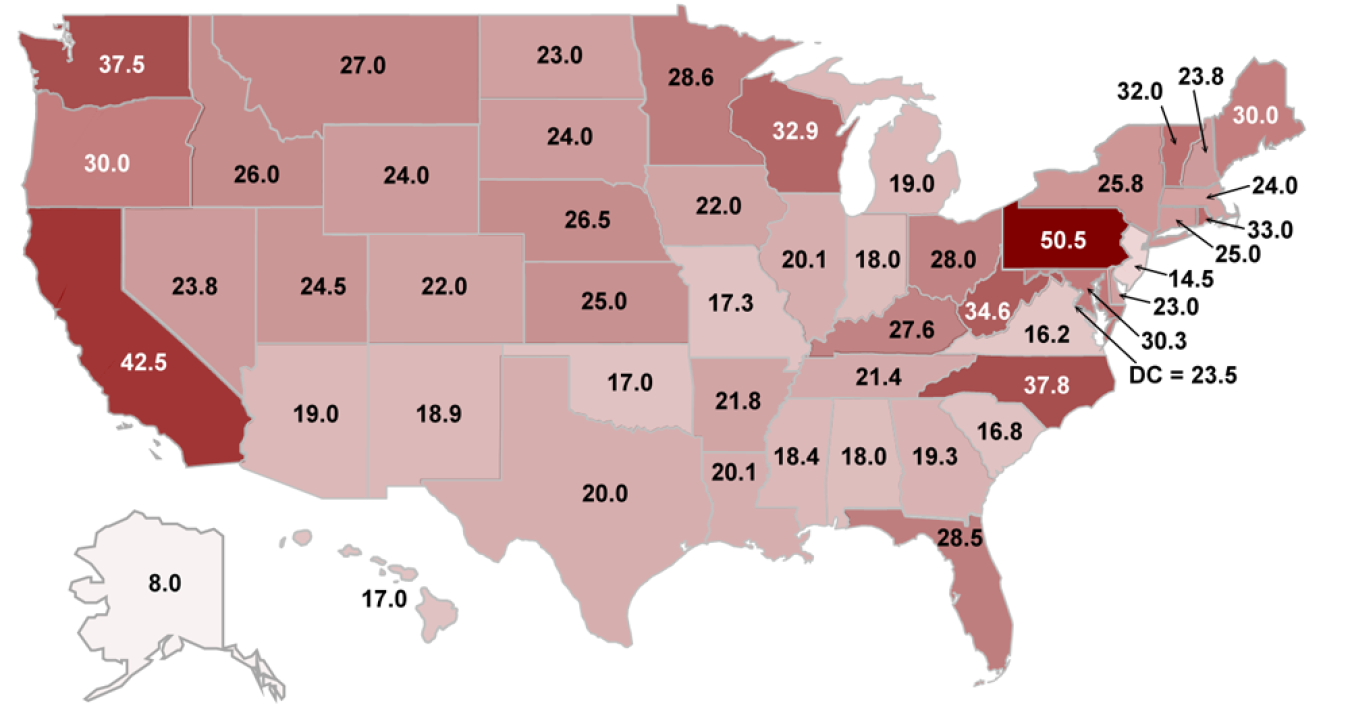

What S The Car Sales Tax In Each State Find The Best Car Price

One exception is the sale or purchase of a motor vehicle which is subject to the South dakota has recent rate changes thu jul 01 2021.

. The South Dakota sales tax rate is currently 45. The south dakota state sales tax rate is 4 and the average sd sales tax after local surtaxes is 583. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

Exact tax amount may vary for different. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. The South Dakota use tax rate is 4 the same as the regular South Dakota sales tax.

Owning a car can be rather expensive from the point of buying it. The South Dakota Department of Revenue administers these taxes. Cities may impose municipal sales and use tax of up to 2 and a 1.

Municipalities may impose a general municipal sales tax rate of up to 2. But that is not all as there are other payments you have to make as well. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

You can find these fees further down on the page. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. Additional address information must be in a column labeled Address2 for file to process.

For vehicles that are being rented or leased see see taxation of leases and rentals. Rate search goes back to 2005. 366 rows 2022 List of South Dakota Local Sales Tax Rates.

The South Dakota SD state sales tax rate is currently 45. Any titling transfer fees. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

Different areas have varying additional sales taxes as well. The average sales tax rate on vehicles across the state is. State sales tax and any local taxes that may apply.

The South Dakota DMV registration fees youll owe. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. South Dakota Vehicle Excise Tax Explained.

There are a total of 290 local tax jurisdictions across. Average Sales Tax With Local. Depending on local municipalities the total tax rate can be as high as 65.

South dakota state rates for 2021. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. All car sales in South Dakota are subject to the 4 statewide sales tax.

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. The cost of a vehicle inspectionemissions test. Additionally if you want to avoid surprise maintenance costs after buying a used car you should think about ordering a vehicle.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. 31 rows The state sales tax rate in South Dakota is 4500.

With local taxes the. The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. Sales tax rates in South Dakota are destination-based meaning the sales tax rate is determined from the shipping address.

One field heading labeled Address2 used for additional address information. Click search for tax rate. One field heading that incorporates the term Date.

In South Dakota each county city and special district can add sales taxes on top of the state rate. The cost of your car insurance policy. Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states.

Including local taxes the South Dakota use tax can be as high as 2000.

What S The Car Sales Tax In Each State Find The Best Car Price

File Southdakota Stateseal Svg Wikipedia The Free Encyclopedia South Dakota State South Dakota Dakota

Credit Card Expense Report Template Elegant Free Simple Contractor Expense Report From Formville Small Business Expenses Report Template Business Expense

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

State Sales Tax Breadth And Reliance Fy 2021 Tax Foundation

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Imgur Com History Notes Imaginary Maps Infographic Map

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

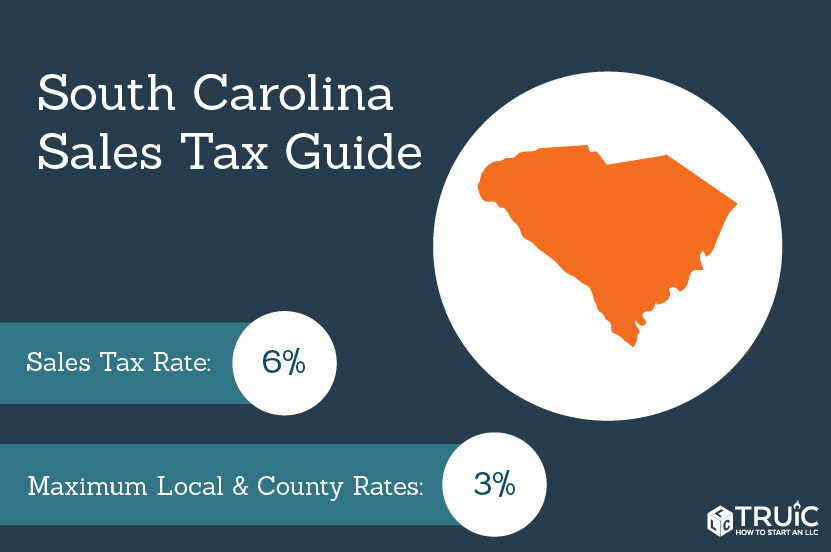

South Carolina Sales Tax Small Business Guide Truic

What State Has No Sales Tax On Rvs Rvshare Com

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Missouri Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price